Introduction:

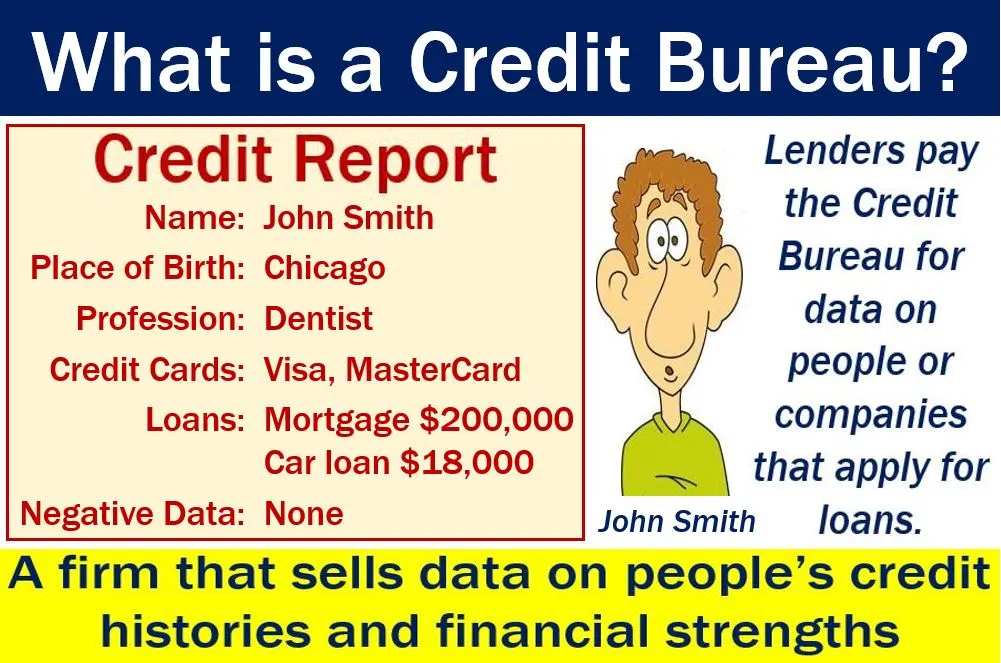

Credit bureaus are the companies that help people to determine the risk of the credit to different people. A credit bureau is a type of institution which provides free financial services to the people. Also contains information related to the creditworthiness of its customers. Generally, people require this credit report so that they can take out loans from the companies.In this article we will see What Credit Bureau Do Most Lenders Use?

If you have the information related to the credit score then you can easily take the loans or invest or get finance on any kind of assets.

Credit bureaus are a way for lenders to determine a borrower’s credit risk. Mostly, they use Experian. Lenders look at a person’s debt and debt-to-income ratio to decide whether or not they’ll extend them credit. If someone comes with a bad credit score, this doesn’t mean that they won’t be able to get a loan from the right company. Sometimes there is a credit bureau dispute within their file which can cause inaccuracies in their report. In cases like these, it may be helpful to have a personal consultation with someone who can help fix your report.

Credit Bureaus agencies

In the US there are different types of credit bureaus that provide information of customers to lenders. For the purpose of analysis, collection, credibility.

- Equifax

Equifax is also one of the credit bureau agencies based on Atlantis where one 20000 employees work for 25 countries. The data of the customer creditworthiness can be news from this agency which provides information related to the US, UK and Russia South America, Arabia Portugal, Singapore.

- Experian

Another credit bureau agency from which information is acquired is Costa mesa. Experience as originally present in the western United States. Actors and information agency which contains the information of the customers around UK Nottingham and Sao Paulo or Brazil.

- TransUnion

Transunion is one of the international companies from the credit bureaus that takes information about the customer’s financial capacity. The regional office of the different areas like Hongkong India Canada South Africa Columbia and Brazil.

- FICO 8:

FICO 8 is the most commonly used bureau for providing credit information to different lenders. Most of the credit bureaus provide information about the consumers so that credit reports can be created and calculated.

The risk of the credit will be lowered when there is a higher score which improves the higher creditworthiness of the customer.

Benefits of credit bureaus

- Pretty: The benefits of using credit bureaus are pretty straightforward. To get a loan, you need to have a good credit score. Credit bureaus provide lenders with your credit history for free. Checking your credit history can help you find out how well you’re doing and if any errors should be corrected before applying for a loan.

- Hold records: Credit bureaus hold records of late payments and unpaid debts. They help ensure that a person doesn’t have more debt than they can handle by providing credit limits. Credit bureaus also keep records of how much a person owes to creditors, whether it’s from an installment loan or a car loan.

- Plentiful: The benefits of using credit bureaus are plentiful. For example, they enable people to build a credit history and access loans more easily. They also provide identity theft protection by collecting information about potential fraudulent activities. However, if you have bad credit or have been denied services in the past, it is important to know that these can still hurt you even if you’re careful with your finances in the future.

- Protect: There are many benefits of using credit bureaus. One of the benefits is that they help to protect your identity and personal information by providing a centralized location that stores your information and monitors it for any changes. Credit bureaus also track the details about companies that you owe money to, making it easier to pay them back. Another benefit is that they help to prevent illegal activity, such as fraud and identity theft.

- Offer: Credit bureaus offer some benefits to both lenders and borrowers. Lenders can use a credit bureau to make a more informed decision before approving a loan. Borrowers can avoid being denied loans by using the services of credit bureaus. These agencies have been around for many years and have helped thousands of people build credit.

How does the credit bureau work?

- Collects: A credit bureau is a company that collects and aggregates financial data on individuals from lending institutions. These agencies then sell the compiled data to various parties, such as lenders, employers, landlords, and retailers. Commonly known as credit bureaus, these companies use this information to generate a person’s credit score or FICO score1

- Credit history: A credit bureau is a company that gathers your credit history information and provides it to other companies. It also collects current information about you, like your income and age, and uses it to assess how much of a risk you are for future borrowing or lending behavior. The three major US credit bureaus are Equifax, TransUnion, and Experian. They’re required by law to give you some of your information for free if you ask them nicely (but may charge a small fee).

- Charge: A credit bureau is in charge of collecting data about the credit history of an individual. The information is then stored in their database that is available to creditors, lenders, insurers, and other organizations that require it when assessing risk. Some credit bureaus use an automated process to generate credit reports.

- Keep track: These agencies maintain records of your credit history. They keep track of information about your payment history, the times you’ve applied for credit cards or loans, and more. If you decide to apply for more than one loan or mortgage, you’ll likely need to supply this agency with more of your personal information.

Conclusion:

From the above article, it is clear that credit bureaus are very important for having a financial service. These agencies maintain records of your credit history. They keep track of information about your payment history, the times you’ve applied for credit cards or loans, and more. If you decide to apply for more than one loan or mortgage, you’ll likely need to supply this agency with more of your personal information.

FAQS

Q1:Why are credit bureaus different?

Answer:The process of all three credit bureaus is almost the same. It is a little different about the security credit history payment history application activity personal data of different customers. These bureaus also collect information from federal and private students of different countries.

Q2:What are the major countries in the credit bureau?

Credit bureaus are the organizations that collect and maintain consumer credit data. There are three major bureaus in the country: Equifax, Experian, and TransUnion.