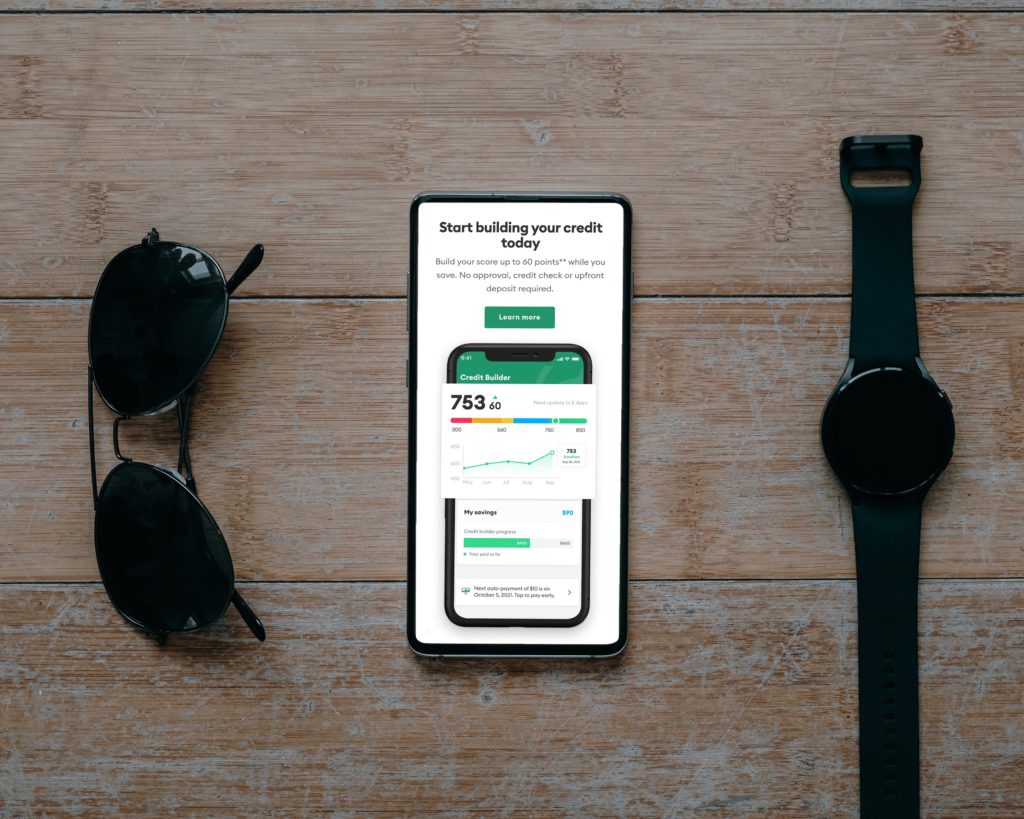

Chime is a private financial service company founded by Chris Britt and Ryan King in the year 2013, its headquarters is in San Francisco California, USA. Chime offers no charges for mobile banking services. Chime is not a banking company, the banking services are provided by Bancorp bank and Stride bank. Other features offered by Chime are as follows: no minimum account balance, early wage access, automated and fee-free savings account, direct deposits, credit/debit cards. Lets know more about Chime Spotme Cashback.

Chime spotme is a new optional no service fee feature eligible to Chime users who receive $200 or more in quantifying direct deposit over the preceding 34 days and those that have activated their debit cards. Chime spotme allows you to do some transactions that overdraw your checking. Limits on spotme are determined based on account activity and history. You can boost your limits on spotme every month when Chime sends out its boosters to eligible members. You can send it to family and friends to boost them, and they can boost you too. The popular question is can I get cash back on Chime Spotme? And the answer is definitely Yes! Spotme overdraft begins from $20 and can be raised to $200. The raising of the spotme limit cannot be done by users manually. It is done depending on the account activity and history. The transaction that goes beyond the customer’s spotme overdraft limit will be rejected. You do not need to link your savings account to your checking account to be able to use spotme as other banks do before they allow overdraft.

These are two major uses of spotme

- You can use spotme for debit card purchases

- Spotme can be for cash withdrawal.

Spotme can not work for the following transactions

- Pay friends transfer

- ACH transfer (direct debits and services)

- ND Chime checkbook transactions.

CHIME LOCATION AND OPERATIONS

Chime does not have a physical location branch but has several retail locations. Chime users can log in through the company’s website or mobile app to carry out their banking transactions. They also provide credit cards and debit cards. These cards are issued by the Bancorp Bank or Stride Bank. They do not charge monthly or overdraft fees, your money on Chime is insured by FDIC. Chime generates its income by collecting a percentage of the transaction fees merchants charge when customers use Chime’s credit card. Chime doesn’t offer the joint account feature. There’s an annual percentage yield of 0.50%. It will also round up every purchase on your Chime debit card to the nearest dollar and deposit that difference into your savings account. You can transfer from your savings account to your checking account or vice versa as many times as you want on CHIME which other banks do not allow.

HOW YOU CAN FUND YOUR CHIME ACCOUNT

With over 90,000 retail locations, you can just walk into any of them, and hand the cashier your money which will be transferred into your account by a third party. Some of the highly known retailers are 7-Eleven, Walmart, Walgreens, Speedway, etc. These retailers charge you a transaction fee for depositing your cash with them. The transaction fee is determined by the retailer not by Chime, so they defer from each other. Cash deposits at only Walgreens are free Within two hours of the deposit, your Chime account would have been funded. You can only deposit in your Chime account three times a day and cannot deposit more than $1000 in 24 hours. Moreso, the maximum amount you can deposit in a month is $10,000.

Another way to deposit into your Chime account is by mobile check transfer from a major bank. You are entitled to do this if you have an account with any of these banks; Bank of America, Fidelity, Capital One, Citibank, Navy Federal, Chase, Charles Schwab, SUN Trust, U.S Bank, USAA, PNC Bank, TD Bank, and Wells Fargo. The transfer period is longer using this method, it takes up to five days to be completed. The transfer limit is $10,000 per day and $25,000 per month.

HOW TO GET CHIME SPOTME CASH BACK

Chime users can withdraw their cash and also receive their cash back at over 60,000 ATMs all over the country and at more than 40,000 of their retail locations just by using the chime debit card. Chime allows its users to use their cash back for almost anything be it shopping, traveling, bill payment, buying groceries, fee payment, etc not only when you need money in emergencies. The amount that is overdrawn is adjusted, and automatically to your next deposit payment with absolutely no charges.

If you’re shopping at any Chime retail location, cashback is very easier. You can just make a payment with your Chime debit card and you will be asked if you would like to receive cash back, and you can receive your cash back at that instant.

Most of the reasons why Chime spotme Cashback doesn’t work is

- The user may have exceeded his/her limit

- The user may have disabled spotme. Just contact Chime support if you’re in this situation.

- The disabled Credit card also causes transaction failure. Contact Chime support for this as well.

- Servers downtime may happen, therefore check if the servers are working before processing any transaction.

FREQUENTLY ASKED QUESTIONS

Who can use Chime?

Any citizen from 18 years and above can use Chime in the U.S. Although Chime cards work all over the world, however accounts are only opened for those who have a valid SSN.

Chime Customer Service hours?

You can reach Chime customer service 24/7 either by email at support@chime.com or by the customer support tab on the Chime app.