Here we will see about the Does Saint Laurent Take Affirmation?

With COVID-19 restrictions limiting movement the world over, online shopping has become the most ideal and convenient way to access goods and services. This search for convenience has influenced how e-commerce itself is financed in the short-term, with buy now, pay later financing (BNPL) platforms becoming increasingly popular during the pandemic era. As such, retailers, too, have decided to tap into the arena by offering buy now, pay later financing as a source of credit for online shoppers. If this service is new or unfamiliar to you, read further to find out more about BNPL financing and online shopping.

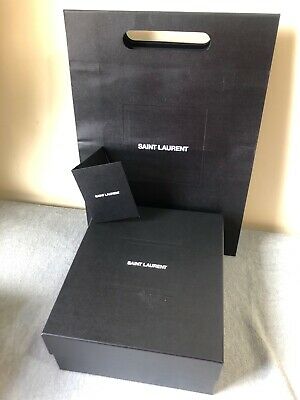

Affirm and Yves Saint Laurent

BNPL firm Affirm has grown popular in the States since the advent of the COVID-19 pandemic. It also counts big names in retail among its partners, including Nike, Saks Fifth Avenue, ThredUP and Best Buy. However, Yves Saint Laurent does not form part of the list, using rival platform Zip Pay instead. Similar to Affirm, Zip Pay – formerly QuadPay – also uses the Pay in 4 model for repayments. It also has some heavy hitters on its retailers list, including Fashion Nova and GameStop. Affirm and Zip Pay both form part of the BNPL space, financing short-term purchases and making it easier for consumers to get access to desired goods instantly. Although these platforms are quite similar in composition and format, there are some key differences that set them apart. Check out the boxes for a blow-by-blow outlook.

Affirm

The pros

Uses Pay in 4 repayment method and is fixed

Fixed interest rate

Allows for flexibility in payment outlets (both online and in-store)

Does not rely on credit checks to grant financing

No account or late fees charged

The cons

Accounts are subject to interest depending on the payment plan elected

Zip Pay

The pros

Uses Pay in 4 repayment method

Varied payment tiers available to choose from

Flexible payment schedule

Increased convenience as it uses a free application for both payment and shopping

The cons

A late fee of $5 can be charged after 21 days of non-payment after the initial fee-free period

Minimum monthly repayments are required starting at $7, 95c*

*Waived should the required amount be repaid in full by the due date

Buy now, pay later? What’s the deal?

Buy now, pay later (BNPL) financing is a source of credit offered to eligible shoppers at participating retailers. Having gained significant buzz since the beginning of the COVID-19 pandemic and seeing as consumers are now looking to digitise their credit and maximise their payment options, BNPL has become a trusty and convenient way for online and in-person shoppers to quickly finance purchases of goods and services.

A typically interest-free payment method, BNPL is exactly what it says it is: a mechanism for customers to purchase what they need (or want!) and make repayments by way of split instalments for a set time period. It also allows consumers the ability to make purchases of any size. Essentially, it’s made instant so that shoppers can get their purchases immediately. BNPL is also a growing player in the global payments arena, with platforms such as Afterpay, Affirm, Klarna and ZipPay leading the pack. This clearly reflects how dynamic consumer behaviour has become over the pandemic period, as consumers themselves have become younger and simply want more options.

There has been quite the boom in the use of BNPL services in the United States, with a 400% increase in the 2021 Black Friday season alone, as well as over 40% of Americans having used BNPL apps. This has meant increased sales for retailers and increased spending for consumers. And although useful in financing short-term purchases, the commitment may prove harmful in the long run if not well-managed.

The benefits of using BNPL services

Aside from the main advantage of convenience, there are other benefits to the use of BNPL financing when making purchases. Buying now and paying allows for consumers to maintain a relatively safe credit score, as BNPL platforms such as Afterpay and ZipPay often lean towards soft credit checks or none at all which do not affect one’s score. Consumers can also repay their debt as per a fixed repayment schedule, with services like Afterpay sending payment reminders. A hidden advantage for retailers is that they are able to recoup profits as purchases are between service providers and stores – without the consumer as the middleman. This, in their view, then increases sales as they are able to use this point as a marketing tool for retail partnerships. However, it is not as simple as it appears, as it comes at a cost.

The risks of BNPL platform use

BNPL has been critiqued as encouraging the accumulation of further debt – dangerous news for an American population which has found itself beholden to a consumerist culture of debt to where it has accumulated debt to the tune of $15 trillion. This is nearly the highest debt ever in the States. Although a novel reinvention to the traditional lay buy, it still remains a source of credit with the same risks attached. This does not bode well for consumers who may have the habit of overspending and overcommitment which may land them in further debt due to the allure of perceived increased affordability.

Missed payments can also mean incurring late fees, which may either impact your credit score or result in your account being handed over to debt collectors. BNPL platforms have also come under fire for not reporting data to credit bureaus and essentially manipulating terms of repayment, leaving customers vulnerable due to the lower number of protections available as they often operate outside the scope of protective legislation such as the Truth in Lending Act. Misrepresentation through marketing materials distances BNPL from being termed as being a credit source and blurs lines for regulation – again, leaving customers vulnerable to impulse buying and debt accumulation.

Conclusion

BNPL financing has become huge over the pandemic period, making the shopping experience easier and more convenient for shoppers across America. With a wide variety of service providers available to choose from, consumers are able to have their short-term needs financed quickly and easily. However, BNPL financing has its own risks, as customers may be vulnerable to overspending and incurring unnecessary debt as it serves as an additional credit source and could impact one’s credit score if not repaid timeously and render one subject to credit checks. It is therefore essential to do research on BNPL financing and only rely on it when making smaller purchases if necessary and to find the platform best suited to your needs.