Most young adults verge into their working career with that simple work at summer camp, places where they had earlier spent their days, or even that favorite place they always eat at. Anywhere these teenagers decide to do summer job helps them become responsible and save up extra money for summer fun or college savings. When it is the period for taxes, various parents may wonder if their children a teenager require to file taxes for the money they made in the summer job.

My Teenager Had a Summer Job Do They Need to File Taxes?

In the United States, everyone including teenagers must file federal tax returns if they earn more than the basic reduction of $12,550 as a W-2 employee. All you have to do is do the math and know if your teen is inclined to file taxes.

Teen and taxes

If your teenager had worked forty hours a week for twelve weeks of that summer, that would amount to four hundred and eighty hours. talent.com points out that the average teen salary across the United States is about $16 an hour. That would amount to $7,680 for the whole summer. In that case, your teen would not have to file a tax return for the tax year.

However, for teenagers who worked as an employee, given that they filled out a W-4 form and their employer removes the taxes from each earning, they might need to file taxes when it is expected, and they might be given a tax refund if they overpaid during the summer.

Teens, Gig Work, Freelancing, and Taxes

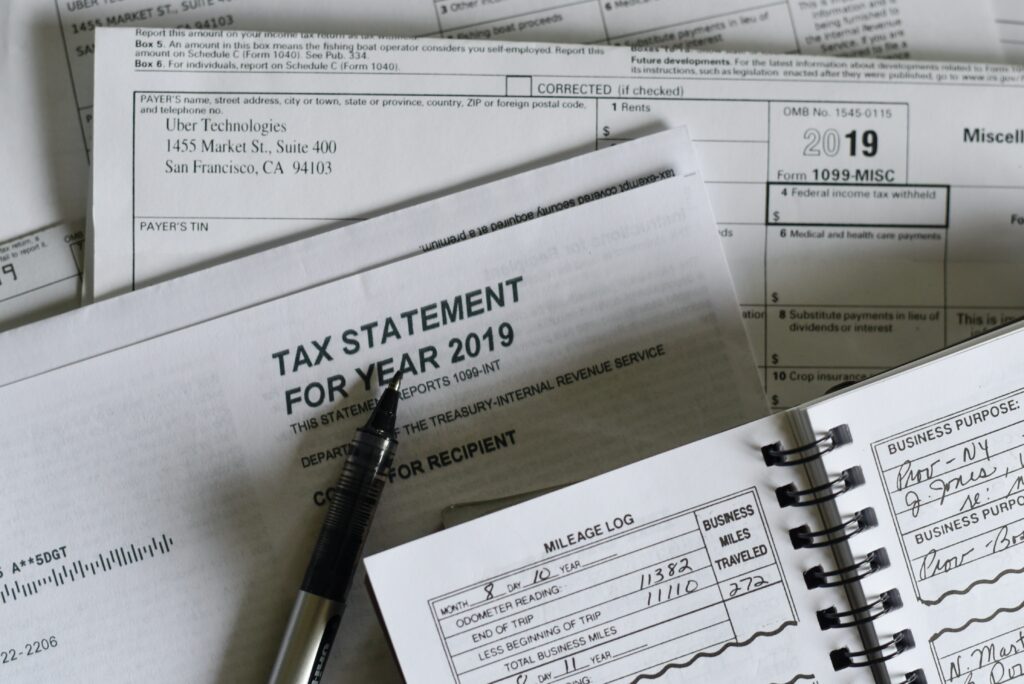

When teenagers take on gig work during the summer as delivery personnel doing odd jobs, using an app, or any other niche in the contracting industry. They might be liable to self-employment tax, and if they made more than $400 in total, working as an independent contractor, they have to file tax returns and pay the self-employment tax.

If your teenager hustled in side jobs and obtained greater than $600 during the summer, the company that employed them might deliver a 1099 form. Your teen must file a tax return to declare income and pay self-employment tax if they get the form, they must file a tax return to declare since there is no minimum age requirement for filing a tax return. However, there is a basic reduction limit of $6,350.

A different tax is filled for when a student who is working earns greater than this. There are also different filing requirements concerning investment dividends and interest; this is known as “unearned income” and it applies to teenagers. When the yearly total of unearned income is more than $1,050, then a return must be filed.

Teens are asked to fill out a W-4 for when they start work so their employer can deduct appropriately their taxes from their paychecks, all federal and state income taxes. Inquire with a tax expert, but it is usually a good decision for a teenager to claim zero exemptions to make sure enough is deducted and they do not end up owing the IRS come tax season. They would get a refund if the income from their summer job does not amount to $9,500.

A high schooler needs to file a tax return when they earn more than $400 and work a job that qualifies them as self-employed However, they would get a Form 1099 if they earned greater than $600. Tax payments all depend on how much they earned working in the summer; they will still owe self-employment tax, although federal income tax might not be included.

Exemptions on Self-employment Tax Payment for Teens

There are many self-employment exemptions to put into consideration, even for teens. For instance, the IRS sees teenagers who give babysitting and lawn-care services as household employees, and teens who are not up to eighteen are not charged Social Security and Medicare taxes. This exact exemption goes for teens below eighteen who earn as newspaper carriers, vendors, and distributors. Dependent teenagers with a job requiring W-2 with no investment usually file the Income Tax Return for Single. A tax expert can also be involved in more complex cases.

Conclusion

In the United States, everyone including teenagers must file federal tax returns if they earn more than the basic reduction of $12,550 as a W-2. Teens are asked to fill out a W-4 for when they start work so their employer can deduct appropriately their taxes from their paychecks, all federal and state income taxes. Inquire with a tax expert, but it is usually a good decision for a teenager to claim zero exemptions to make sure enough is deducted and they do not end up owing the IRS come tax season.

Frequently Asked Questions

Do minors have to file taxes?

Yes, there is no age limit to filing taxes.

Do sixteen-year-olds pay taxes?

It does not matter your age; if your income exceeds a certain amount, you will need to file a tax return. This affects children of all ages as well unless their earnings, earned and unearned, are under a limit and another taxpayer can assert them as a dependent on their return.