Have you often received phone calls from banks offering you a credit card? Do you have a credit card but no idea how to use it? Or are you thinking of having a credit card but confused about how to use it? Well, here is this article that will explain everything about credit cards and credit scores. Read till the end to know more. Let us know more detail about ‘What Is A Good Credit Score?’.

What Is A Good Credit Score?

Credit Scores will differ based on the standard system being followed. Considering FICO, a credit score near or above 700 is generally a good one for most cases.

Credit Score:

A 3-digit number that ranges between 300 and 850 is known as a credit score. it tells you the creditworthiness of the individual.

To put it simply, an individual’s ability to repay his/her debt is calculated according to one’s it. A good credit score means you have a whole lot of benefits.

it is calculated based on various factors such as loan and credit card repayment history, your annual income, the number of credit cards you have, how you use them, and finally your total balance on the credit card. A bank or a company’s decision to offer you a mortgage, loan, credit, and credit products will be based on your it.

What is a good credit score?

The normal will range from 300 to 850. However, this normal range may also vary from 300 to 900. it is generally classified from bad score to excellent it based on the data below.

- Bad – Below 300

- Fair – 580 to 669

- Good – 670 to 739

- Very Good – 740 to 799

- Excellent – above 800

The above-mentioned scores are based on FICO scores. 900 is considered the highest credit score. Yet, it may vary from one financial institution to the other. However, some financial institutes also use another method called the Vantage scoring system to calculate the credit scores. In vantage systems, there may be a variation in classifying good credit scores.

Benefits of having a good credit score:

- Firstly, your creditworthiness will be judged based on your credit score.

- it allows you to quickly get approved for your loans, credit cards, etc.

- Also, you will get low-interest rates for your loans as well as for your credit cards.

- Some insurance companies check in case of high premium insurance. Specifically, when you apply for car insurance, an insurance company will look for your credit score to accept your insurance or deny it.

- Also getting rental apartments or houses will be easy with a good credit score.

- When you maintain a good score, there is a better chance for you to get higher credit limits in your bank.

- Even some companies check your credit score as a part of a background check in case of hiring you.

- A good credit score gives you the privilege of bargaining and negotiation.

Helpful points to maintain a good credit score:

- Check your score every year or if possible every month.

- Understand your credit report and always look for any errors to avoid bad credit scores.

- Learn the factors which affect your score and work on them.

- Know the mistakes which you make and work on them regularly.

- Make your payments regularly and avoid any delay as much as possible.

- Avoid closing old credit cards.

- Don’t apply for a new credit card often.

- Maintain a long credit history if possible.

- Learn about the possible errors which you can make and try to resolve those errors as much as you can.

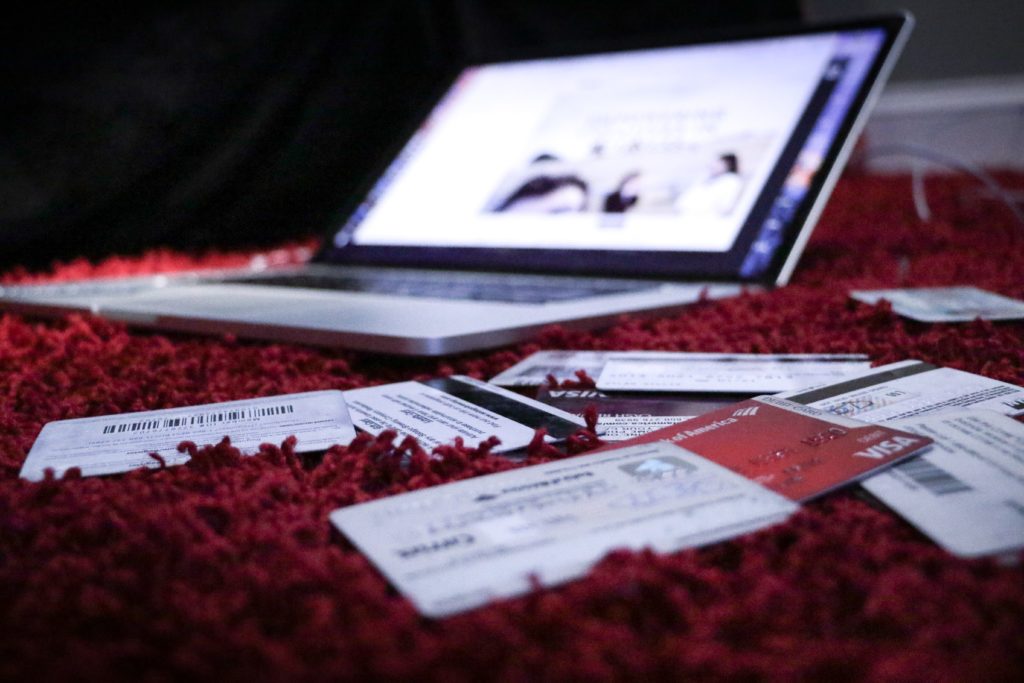

Credit card:

A credit card is a rectangular composite card made of plastic and it is similar to a debit card. A credit card helps you to buy things without cash for a certain limit.

You will have to make a deposit first to get a credit card. Credit cards are issued by financial institutions such as banks, credit card companies, etc. When you make a payment with a credit card, you have to pay it back before the time limit set by your bank.

The time limit is usually 21 to 30 days. The interest won’t be charged if you pay back within the time limit. After the time limit, interest will be added each day till you pay back the amount.

A card will also help you in getting loans in the future depending on it.

Conclusion:

Your credit score is in your hand and it is your responsibility. As we have seen, a good score is useful in many ways. In case of applying for a loan or card, make sure you know your score and it is good.

FAQs:

1) How credit scores are calculated?

Most banks use the FICO scoring system to calculate credit scores. The vantage scoring system is the most used system after FICO.

2) How to know what my it’s score is?

You need to contact credit bureaus in your country to know your credit score.

3) Will I be charged for wanting to know?

Some companies don’t charge you for getting a credit score. However, it depends on the source from which you want to know your credit score.

4) What does credit limit mean?

It is the maximum amount of money allowed by your creditor for you to spend. If your credit limit is $2000 and you have used $1200, you will have only $800 to spend further.

Disclaimer: This article is not written by professionals in the financial field. Therefore, readers are advised to consult a professional in the relevant field before making any decision.